The Supreme Court heard oral arguments Tuesday in two challenges to President Joe Biden’s student debt relief plan, with several conservative justices appearing skeptical of the government’s authority to discharge millions of dollars in federally held loans.

If the conservatives do ultimately rule in favor of the policy’s challengers, the hearing made clear they will have to grapple with the legal questions around why states and individual borrowers should be allowed to sue over the program – questions that emerged as a flash point during the arguments.

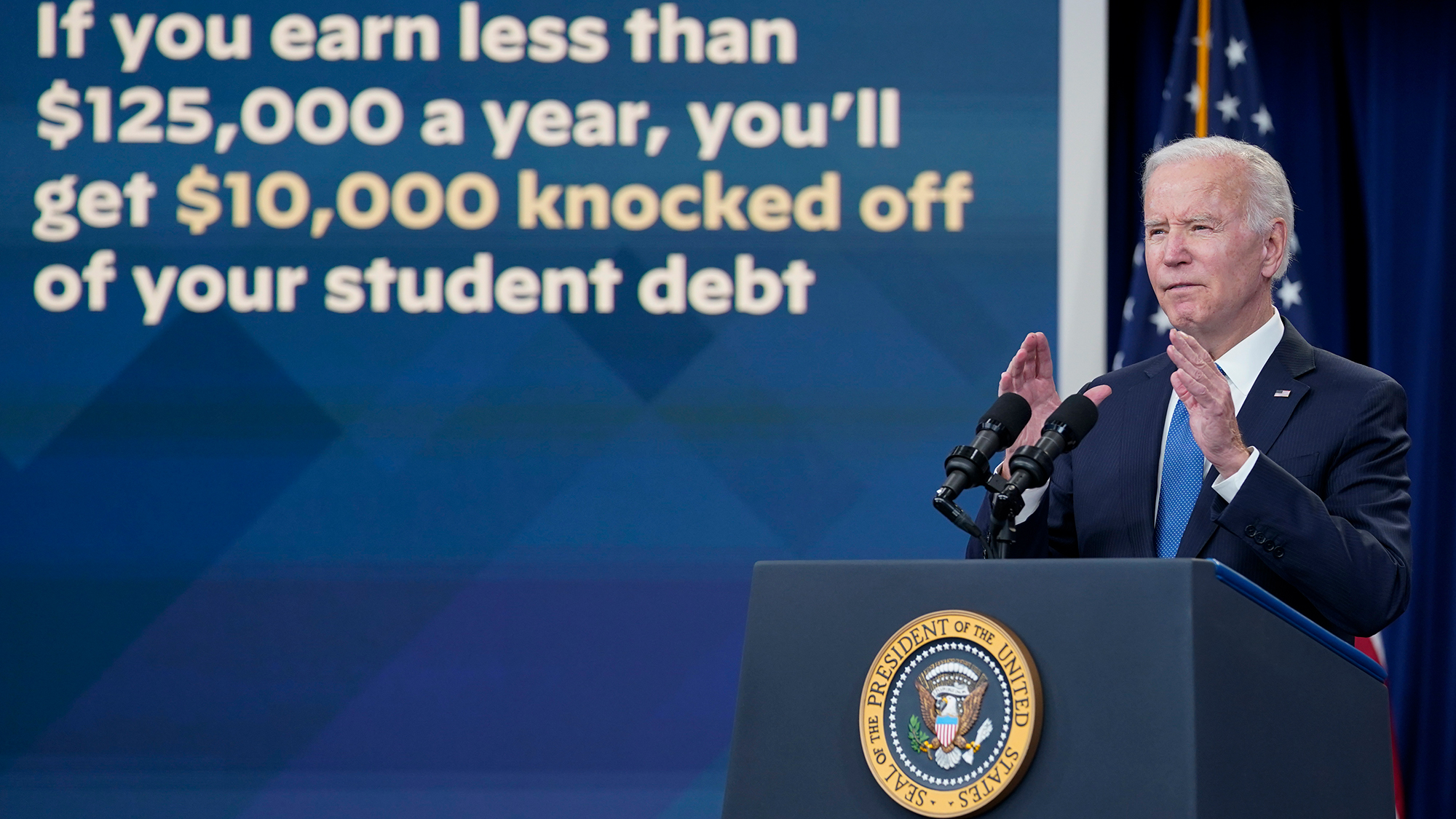

Millions of qualifying student loan borrowers could see up to $20,000 of their debt canceled depending on the outcome of the arguments. How and when the justices rule will also determine when payments on federal student loans will resume after a pandemic-related pause was put in place nearly three years ago.

In Biden v. Nebraska, a group of Republican-led states argued the administration exceeded its authority by using the pandemic as a pretext to mask the true goal of fulfilling a campaign promise to erase student-loan debt.

The second case is Department of Education v. Brown, which was initially brought by two individuals who did not qualify for the program and argue the government failed to follow proper rulemaking process when putting it in place.

Here are some takeaways from the oral arguments:

Conservatives see this case as another chance to rein in aggressive actions by Biden: In the questions the conservative justices posed, they signaled that they see the GOP states’ case as presenting the court with another chance to draw the lines around when the executive branch can and cannot act without Congress.

Several of the exchanges concerned the application of the so-called “Major Questions Doctrine,” a legal theory embraced by the court’s Republican appointees that says Congress can be expected to speak with specificity when it gives an agency power to do something of great political or economic significance.

The states are arguing that under the doctrine, the Biden student debt program should be blocked.

Chief Justice John Roberts said to US Solicitor General Elizabeth Prelogar that the case “presents extraordinarily serious important issues about the role of Congress.”

Justice Brett Kavanaugh asked Prelogar to compare the dispute to cases in the court’s history where the court ultimately pushed back against government claims that a national emergency justified the aggressive, unilateral action by the executive branch. And Justice Neil Gorsuch asked Nebraska Solicitor General James Campbell, who is representing the red states, a series a questions that seemed aimed at helping the court further flesh out the doctrine.

Lawyer for GOP state gets grilled on standing: Whether the GOP states are threatened by the type of harm that makes it appropriate for a court to intervene was a major theme. Nebraska Solicitor General James Campbell received a series of questions – from justices on both sides of the ideological spectrum – about whether the states had overcome this procedural threshold, which is known as “standing.”

A particular flashpoint in the hearing was the states’ arguments that the loan forgiveness program’s potential harms to MOHELA – the Missouri-created entity that services loans in the state – gives Missouri standing. Several justices noted that MOHELA could have filed its own lawsuit challenging the program, but has not.

Barrett may be a justice to watch: Justice Amy Coney Barrett has stood out among the conservatives for asking particularly pointed questions of the GOP states about their standing arguments, setting her apart as a potential pick up vote for the court’s three liberal members.

“If MOHELA is an arm of the state, why didn’t you just strong-arm MOHELA and say you’ve got to pursue this suit,” Barrett asked Campbell, among several questions she asked him about the states’ standing claims.

Even if Barrett swings to the liberals to vote that the lawsuit should be rejected because of the standing concerns, the Biden administration will need the vote of one more GOP-appointed justice.

Sotomayor raises the practical stakes of the case: In extended remarks to Campbell, Justice Sonia Sotomayor laid out the practical implications of the case in stark terms.

“There’s 50 million students who are – who will benefit from this. Who today will struggle. Many of them don’t have assets sufficient to bail them out after the pandemic. They don’t have friends or families or others who can help them make these payments,” she remarked. Those debtors will suffer in ways others won’t because of the pandemic, she said.

“And what you’re saying is now we’re going to give judges the right to decide how much aid to give them instead of the person with the expertise and the experience the secretary of Education who’s been dealing with educational issues and the problems surrounding student loans,” she said.

Read more takeaways here.