The so-called "Major Questions Doctrine" is already seeing a lot of attention as the red states’ case is debated before the justices on Tuesday.

But what exactly is it?

Last term, the court cited the “Major Questions Doctrine” in a 6-3 decision that curbed the Environmental Protection Agency’s ability to broadly regulate carbon emissions from existing power plants.

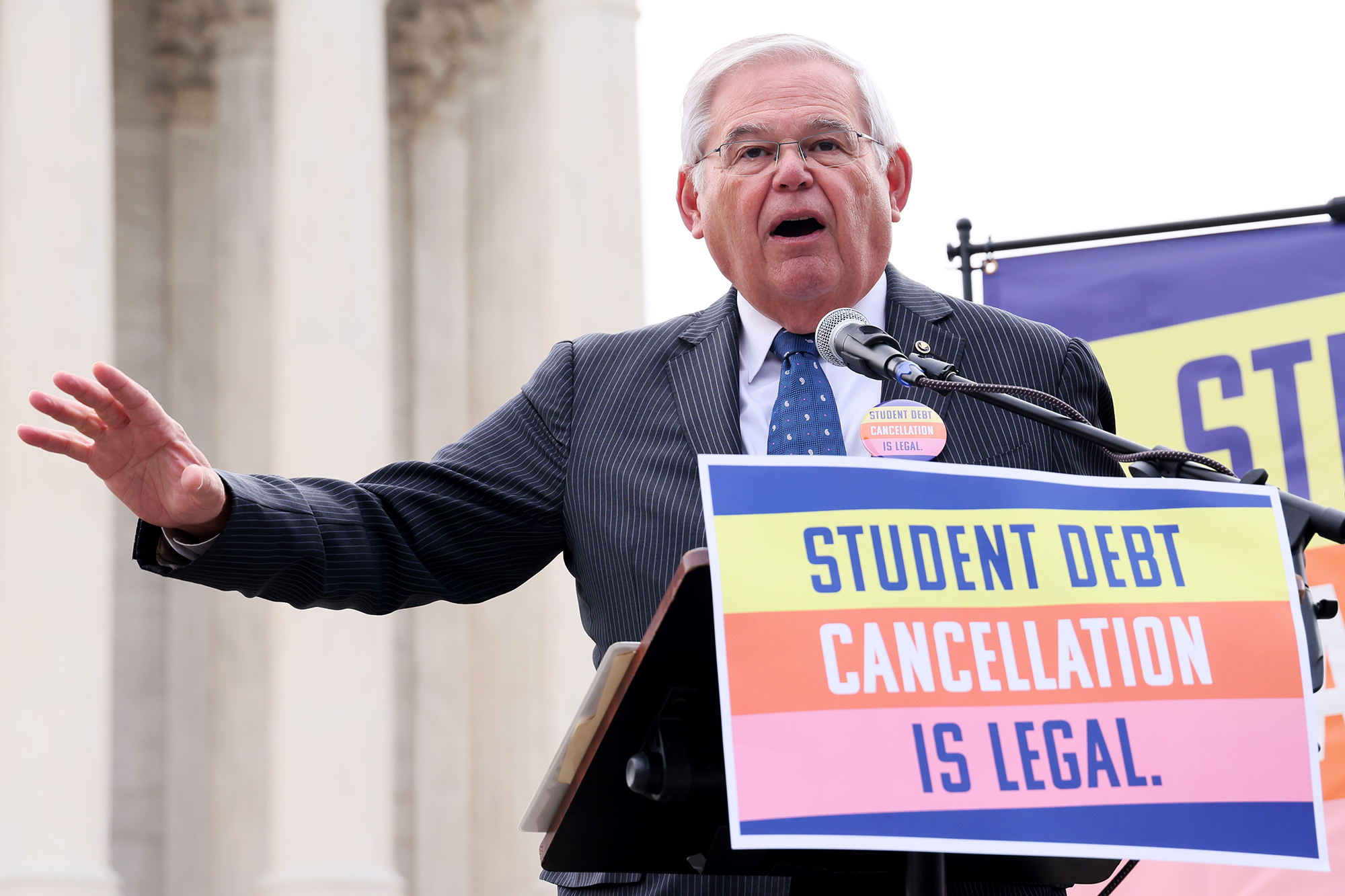

Under the theory, if an agency acts in a way that could have major political or economic implications, it must have the authority of Congress. The states are saying here that essentially, the college debt relief plan is too big for the Biden administration to use the authority in its citing.

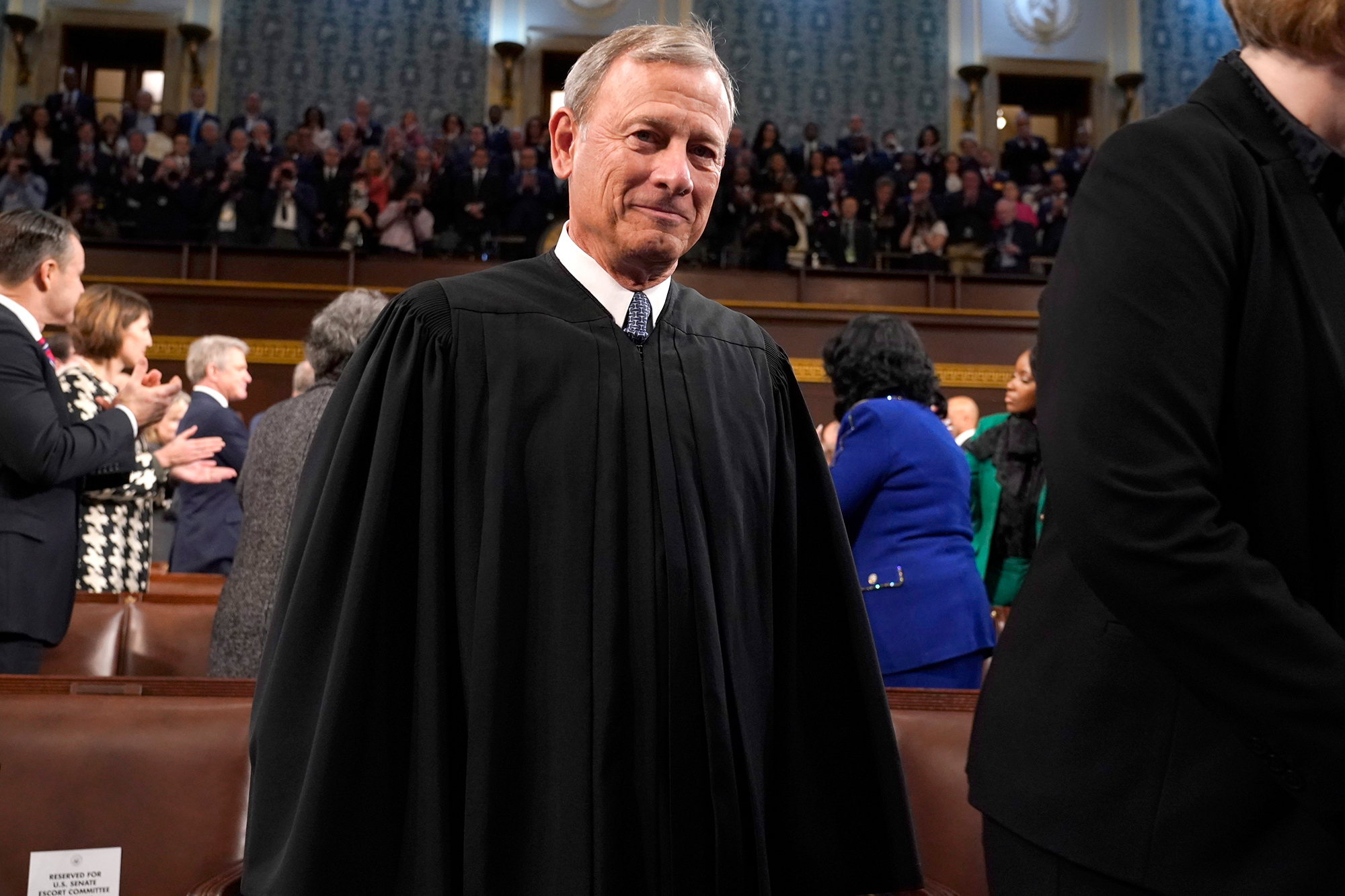

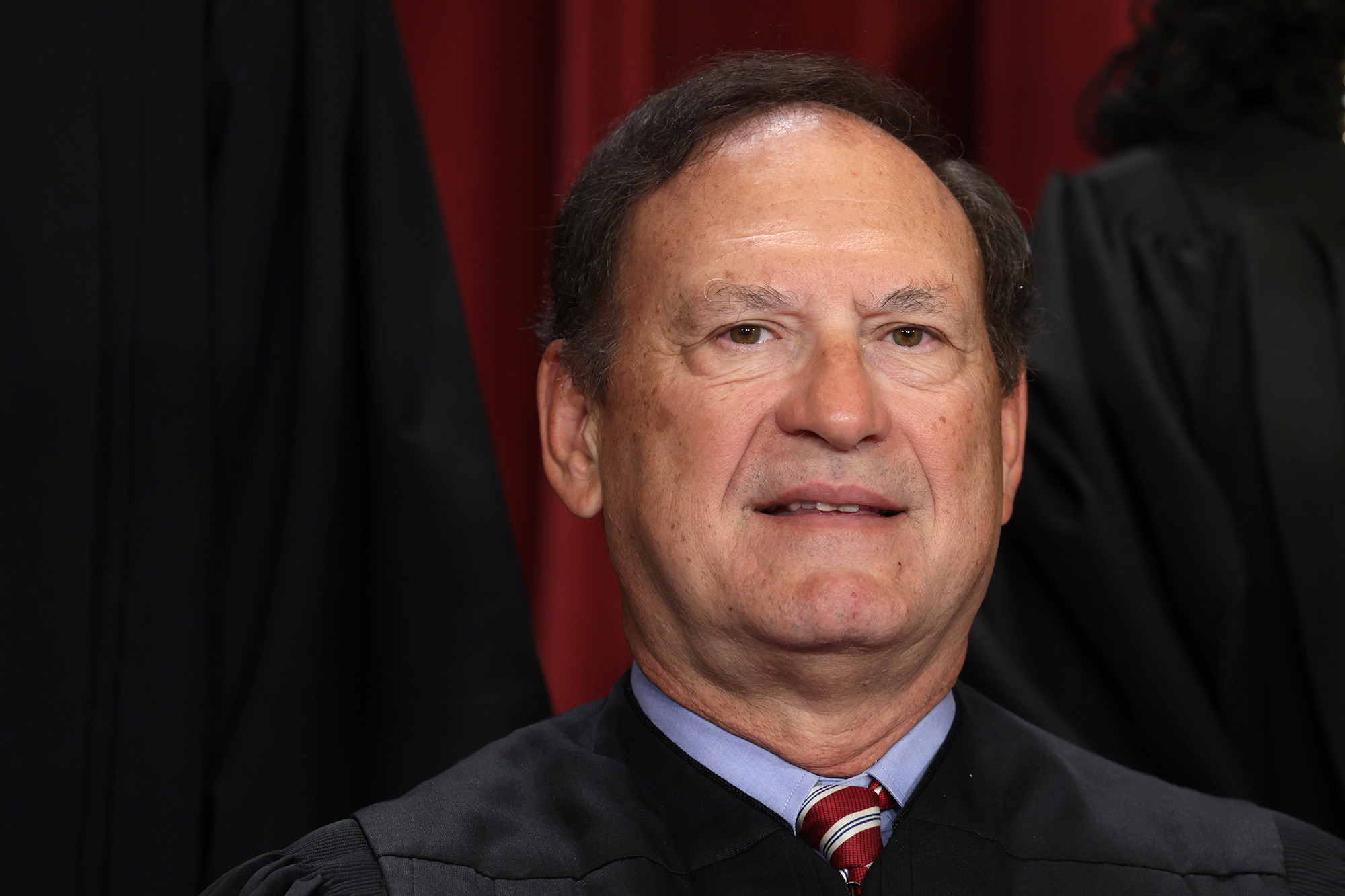

It's an argument that will appeal to the court's conservatives and their 6-3 majority over the liberals. Justice Samuel Alito, for instance, brought it up.

“Is this the sort of thing that Congress is likely to address expressly or through a contestable interpretation of some statutory language?” Alito asked US Solicitor General Elizabeth Prelogar.

“Well, of course, we think Congress did address this expressly here. And Congress directed that in the context of a national emergency – that is the limitation of the HEROES Act.” Prelogar replied.

“The (Education) secretary acted within the heartland of his authority and in line with the central purpose of the HEROES Act in providing that relief here. To apply the Major Questions Doctrine to override that clear text will deny borrowers critical relief that Congress authorized and the secretary deemed essential,” Prelogar said.