A version of this story first appeared in CNN Business’ Before the Bell newsletter. Not a subscriber? You can sign up right here. You can listen to an audio version of the newsletter by clicking the same link.

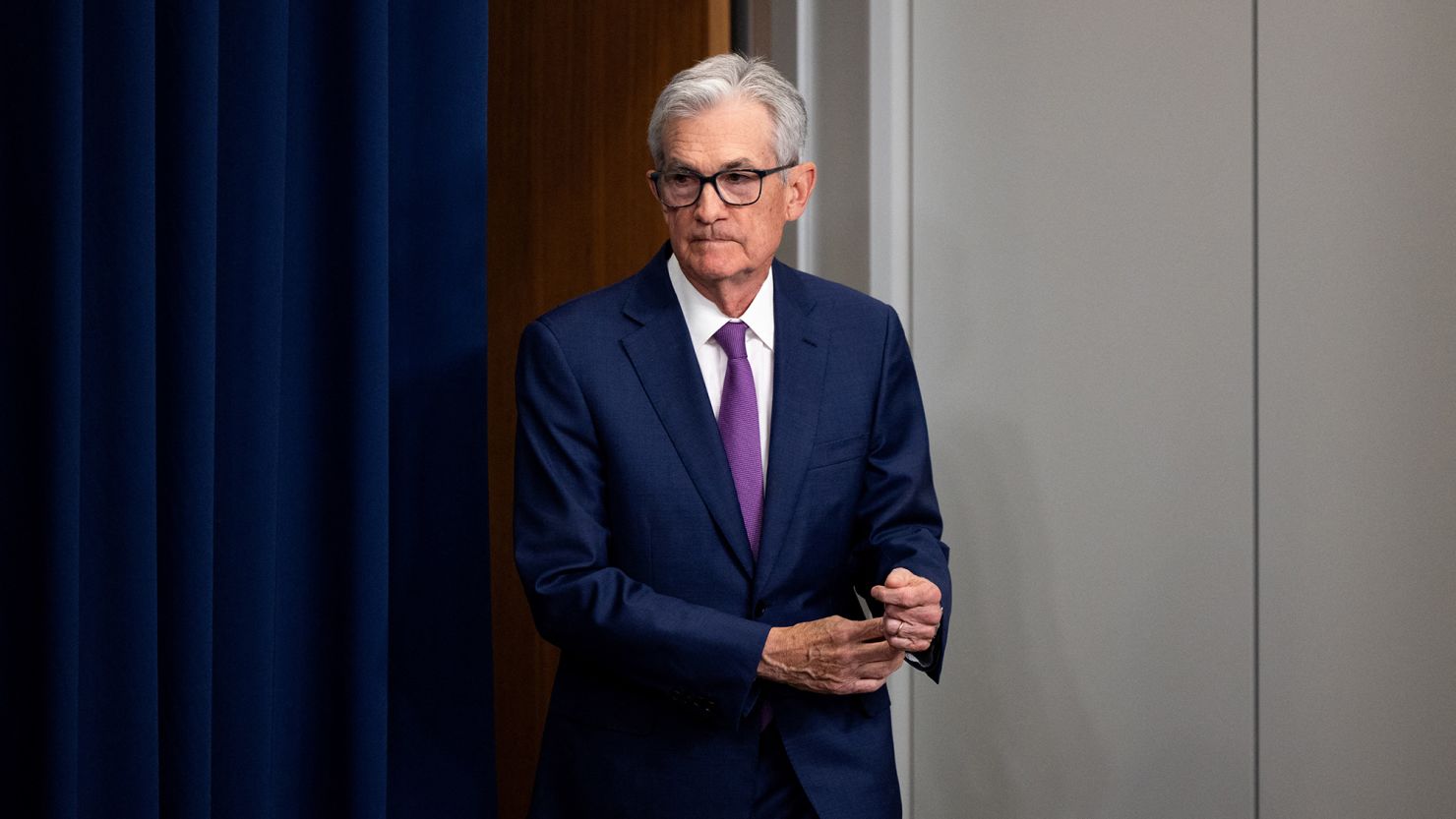

Uncertainty around the economy and the Federal Reserve’s next moves has cast a shadow over Wall Street this month. Fed Chair Jerome Powell has a chance to provide more insight when he testifies before Congress on Wednesday and Thursday.

Markets have whipsawed between new highs and precipitous drops as contrasting economic data cause confusion about what the Fed will do next.

That market seesaw could continue this week as Powell’s semi-annual congressional testimony provides investors with a rare opportunity to hear the Fed head’s views on a range of topics from inflation to regional bank health.

Here’s what investors will be listening for, and reacting to, over the next two days.

Inflation expectations: Powell’s messaging on Fed policy over the past few months has been fairly consistent — he’s made it clear that he’s in no rush to cut interest rates.

“Basically, we want to see more good data. It’s not that the data aren’t good enough. It’s that there’s really six months of data. We just want to see more good data along those lines,” he said on 60 Minutes last month.

But that statement came before a month of not so good data — price rises accelerated in January from the previous month and wholesale inflation saw its biggest monthly increase since August.

Those reports pushed back market bets on when the Fed will start cutting interest rates. The majority of investors are now expecting an interest rate cut at the Fed’s June policy meeting, according to the CME FedWatch tool. Just one month ago they thought it would be in May.

Investors will closely listen for any hints from Powell about what the Fed is looking for, data-wise, before it begins to lower interest rates.

Economic outlook: Even as inflation surprised to the upside last month, the economy held up better than expected.

After more than 20 months of inflation above the Fed’s 2% target and higher borrowing costs, investors, economists and — eventually — Federal Reserve officials said they expected the economy to soften this year, allowing the central bank to finally start cutting rates.

But economists at S&P 500 Global Ratings now expect US real gross domestic product to grow by 2.4% in 2024, up from their forecast of 1.5% in November. The labor market remains incredibly resilient, with unemployment at historic lows and wage inflation elevated.

Investors will look to Powell to comment on how long he thinks the economy can perform well while interest rates are high.

Powell will also be asked about the economic pain Americans are feeling as a result of elevated inflation and interest rates.

Rep. Emanuel Cleaver, a Missouri Democrat, told Politico that he’s thinking of asking Powell why “the American public does not feel as if the economy is anywhere close to the level that I know it to be based on my everyday involvement with this committee.”

Americans have been struggling with higher prices, especially for essentials like rent, groceries and gas. Food prices rose 0.4% between December and January, the highest monthly rate in a year. Mortgage rates have climbed for four weeks in a row.

Regional banks: “We’ll be listening for any commentary from Powell on the soundness of regional banks in light of their commercial real estate exposure,” said Dave Sekera, chief US market strategist at Morningstar.

New York Community Bank announced that it had taken large hits in its commercial real estate exposure earlier this year, and shares of the bank have tumbled to their lowest level since 1996 after the beleaguered regional lender said in a filing last week it had identified “material weakness” in the company’s controls.

The news sent the bank’s bonds tumbling as well as investors worrying about more disruption to the regional banking sector.

The stock was further pressured Friday after Fitch Ratings downgraded NYCB’s debt to junk status and Moody’s Investors Service lowered its rating further into junk territory.

What could happen: Don’t expect Powell to be too forthcoming.

As former Fed economist Claudia Sahm said it in her latest newsletter, “It would be un-Fed-like to tell us how many more months of good data it needs to be confident [of cutting rates].”

Powell is expected to emphasize the need for more patience. Federal Reserve officials, including Powell, have repeatedly said they envision at most three rate cuts in 2024 and indicated that they’re in no rush to get there.

There’s a gold rush on Wall Street

Goldbugs are rejoicing as their favorite precious metal continues to reach new heights, reports my colleague and Before the Bell co-writer Krystal Hur.

The price of gold rose on Tuesday to settle at $2,141.90 a troy ounce, notching another record high as investors continue to bet the Federal Reserve will cut rates in the back half of the year.

Gold is considered to be one of the most resilient investments. When interest rates fall, holding income-paying assets (like bonds) becomes less appealing than owning the precious metal. However, some investors also believe gold to be a hedge against inflation, wagering that it will hold its value even if it begins to surge.

It’s not just traders trying to get in on the gold rush. Costco started selling gold bars last September and sold more than $100 million during its fiscal first quarter of 2024. The precious metal tends to be popular during times of global economic unease, since it’s a tangible asset and less risky than stocks.

Apple iPhones sales fall 24% in China

iPhone sales in China dropped 24% in the first six weeks of 2024, according to a new report, adding to significant problems for Apple and other Western tech companies in a crucial market, reports my colleague Samantha Murphy Kelly.

Analysts from Counterpoint Research said the overall mobile market in China fell by 7% with companies including Apple, Oppo and Vivo experiencing declines.

But the problem for Apple has been ongoing for a year as China’s economy slows down and trade tensions and nationalism heat up. Customers that once would have considered Apple are now turning to national brands, particularly Huawei, Counterpoint said.

“Primarily, [Apple] faced stiff competition at the high end from a resurgent Huawei while getting squeezed in the middle on aggressive pricing from the likes of Oppo, Vivo and Xiaomi,” Mengmeng Zhang, a Counterpoint senior analyst, said in a press release. “Although the iPhone 15 is a great device, it has no significant upgrades from the previous version, so consumers feel fine holding on to the older-generation iPhones for now.”

Apple shares slid 2.8% on Tuesday. The stock has fallen about 11.6% this year on concerns about weakening sales, particularly in China.