A version of this story first appeared in CNN Business’ Before the Bell newsletter. Not a subscriber? You can sign up right here. You can listen to an audio version of the newsletter by clicking the same link.

Analysts have long expected a slowdown in the US labor market, but for the past 10 months, the data has come in better than expected.

That may sound like a good thing for the economy, but as the Federal Reserve attempts to fight inflation, the still-hot jobs market is signaling that more painful interest rate hikes could be ahead.

But lately, some economists have begun to worry that the data on which Fed officials rely is becoming increasingly inaccurate. The number of people responding to labor market and inflation surveys has been declining for years, and the pandemic accelerated that slowdown. That causes more volatility in the incoming data and hence more volatility in markets, economists say.

The Job Openings and Labor Turnover Survey, or JOLTS, a monthly data set that’s closely watched by the Fed and markets, has seen its response rate fall sharply since the pandemic — it is now just under 31%.

Julia Coronado, founder of MacroPolicy Perspectives and president of the National Association for Business Economics, said earlier this month that the decline in responses made the survey “basura,” the Spanish term for trash.

It’s not just JOLTS — the response rate for the Employment Cost Index, a pay measure also watched by the Fed, has dropped from about 75% in 2012 to under 50% today, according to Bureau of Labor Statistics data. The response rate to the Current Employment Statistics survey, which reports on payroll and wages each month, has fallen from 60% in 2019 to under 45% at the end of 2022.

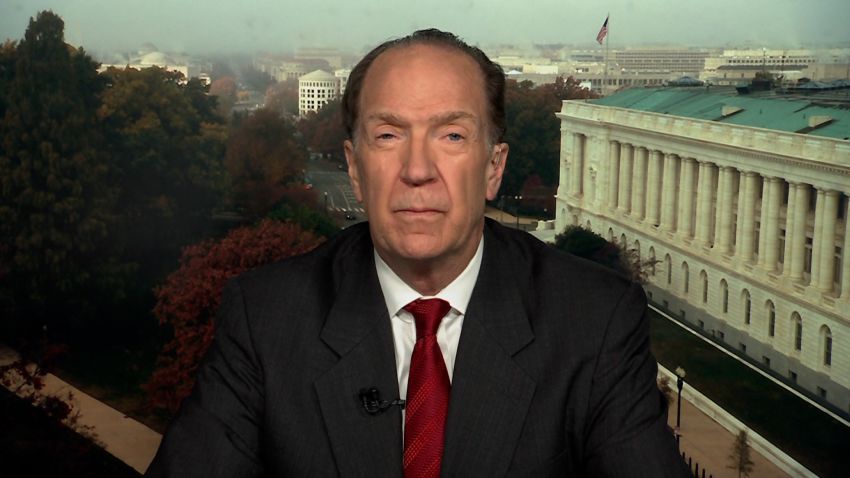

CNN spoke with Torsten Slok, chief economist at Apollo Global Management about the declining rates. The interview has been edited for length and clarity.

This seems like a long-term problem … Is there an easy fix?

With the growth of spam and a decline in the number of telephone landlines there has been a structural decline in response rates and there is no easy solution to this problem, which is getting gradually worse and worse.

To what extent are declining response rates to surveys actually impacting the data we use? Are we talking about major gaps in our reading of the economy?

It is absolutely critical for the Fed and markets that the incoming data is as reliable as possible. For example, is the strong data we have seen in January for employment and retail sales a true description of what is going on? Is it driven by problems with seasonal adjustments, or problems measuring employment and consumer spending in the economic surveys?

Is the Fed aware of this and how do they factor that in as they determine policy?

When the macro data becomes unreliable there is a higher tendency to put weight on anecdotal evidence, which for example can be seen at the moment where the announced tech layoffs seem like a big deal — but they are basically irrelevant when compared with the recent data in the latest employment report for January, where the economy created 517,000 jobs.

The leisure and hospitality sector alone added 128,000 jobs in January, more than all tech layoff announcements combined. Is this a true description of what is going on or is the source of this discrepancy some measurement problems with the data we are looking at?

What kind of volatility does this cause in markets? Why?

With the Fed’s dual mandate of full employment and stable prices it is absolutely critical that the Fed and markets have a true description of what is going on with inflation and unemployment.

Buffett, Goldman Sachs and dining out: What traders are watching today

▸ Last year was tough for most investors, Warren Buffett included.

Berkshire Hathaway, Buffett’s conglomerate, reported big losses on Saturday. In total, it lost about $22.8 billion in 2022 — with around $53.6 billion in unrealized losses on its investments.

Still, Buffett pointed to the company’s operating earnings in his annual letter to investors — those are the profits that come from businesses and not stock holdings, and are Buffett’s preferred measure of profitability. Those earnings reached what Buffett called a “record” — $30.8 billion in 2022, topping the $27.5 billion in the prior year.

Buffett, meanwhile, sang the praises of share buybacks in his letter.

The 92-year-old “Oracle of Omaha” wrote that “when you are told that all repurchases are harmful to shareholders or to the country, or particularly beneficial to CEOs, you are listening to either an economic illiterate or a silver-tongued demagogue (characters that are not mutually exclusive).”

▸ Goldman Sachs will host its investor day on Tuesday (February 28). This will be a big one for the company’s leaders as they hope to reset after a 2022 that saw the bank’s profits slump by nearly half.

It’s only the second annual investor meeting in 154 years, and comes just weeks after the company said its consumer lending arm has lost almost $3 billion since 2020. The bank has recently undergone a series of layoffs and CEO David Solomon has faced criticism, and a pay cut, from shareholders.

▸ There are fewer US restaurants today than in 2019. It’s not clear when — if ever — they’re coming back, reports CNN’s Danielle Wiener-Bronner.

Last year, there were about 631,000 restaurants in the United States, according to data from Technomic, a restaurant research firm. That’s roughly 72,000 fewer than in 2019, when there were 703,000 restaurants.

That number could fall even further this year, to about 630,000 locations, according to Technomic, which doesn’t foresee the number of restaurants in the United States returning to pre-Covid levels even by 2026.

Chipotle, Starbucks, Chick-fil-A, McDonald’s and KFC-owner Yum Brands, meanwhile, have each donated $1 million to Save Local Restaurants, a coalition opposing a California law that could set the minimum wage at up to $22 an hour and codify working conditions for fast-food employees in the state.

More confusing data

In a time when the economic data has delivered mixed messages or flat out busted expectations, economists’ predictions for the year ahead are growing increasingly opaque, reports CNN’s Alicia Wallace.

The National Association for Business Economics’ latest survey, released Monday, shows a “significant divergence” among respondents about where they think the US economy is heading in 2023, the organization’s president said.

“Estimates of inflation-adjusted gross domestic product or real GDP, inflation, labor market indicators, and interest rates are all widely diffused, likely reflecting a variety of opinions on the fate of the economy — ranging from recession to soft landing to robust growth,” Julia Coronado, NABE’s president, said in a statement.

Nearly 60% of survey respondents said they believe the United States had a more than 50% shot of entering a recession in the next 12 months.

When such a recession would start was another matter: 28% said first quarter, 33% said second quarter, and 21% said third quarter.