Federal Reserve chairman Jerome Powell warned that the central bank’s mission to tame inflation will result in “some pain” for US households.

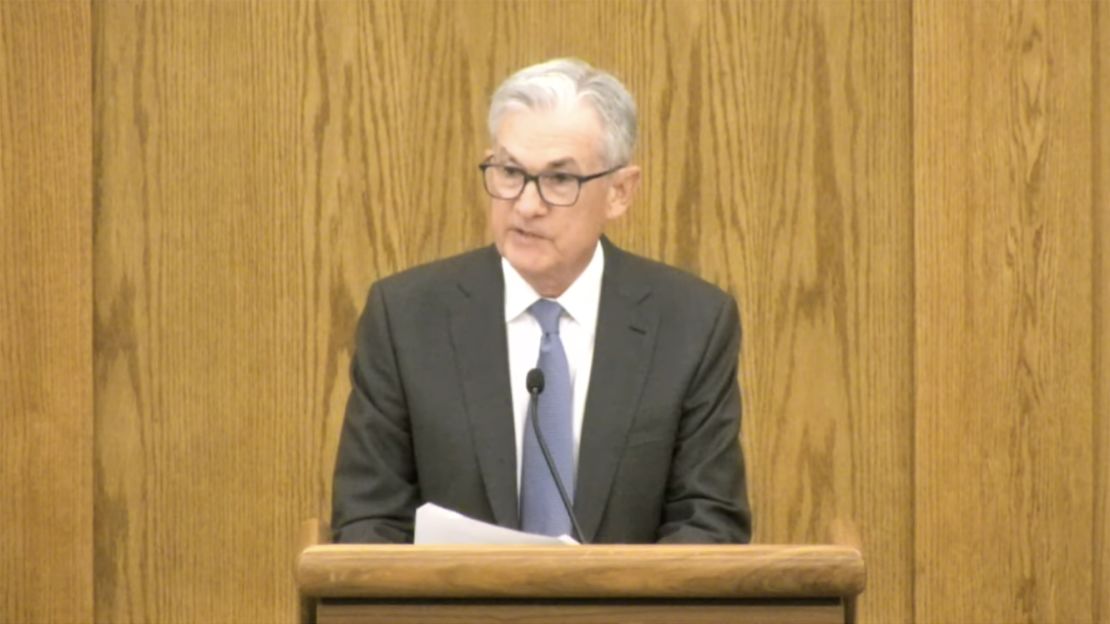

In a keynote speech at the Federal Reserve’s annual Jackson Hole Economic Symposium Friday morning, Powell said that the path to reducing inflation would not be quick or easy, adding that the task, “requires using our tools forcefully to bring demand and supply into better balance.”

Doing so, he said, would likely result in some weakening of the US economy and job market.

“While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses,” said Powell.

“I would interpret that as a willingness to see the unemployment rate creep a little higher here to get to that end of reducing demand,” said Rob Haworth, senior investment strategist at U.S. Bank Wealth Management. A weaker labor market generally constricts consumer demand as households conserve cash in anticipation of potential job loss.

Powell also telegraphed a greater sense of urgency about taming inflation than he has in previous remarks, calling price stability “the bedrock of our economy.”

“Our responsibility to deliver price stability is unconditional,” he said.

While Powell did not offer any indication whether the Fed’s extraordinary back-to-back rate hikes of 75 basis points each would be repeated at its rate-setting meeting next month, he sent the clearest message yet that the central bank was unequivocally committed to more restrictive policy in order to rein in inflation.

“It definitely increases the possibility of 75 [points]”, said Jay Hatfield, founder and CEO of Infrastructure Capital Management. “He clearly implied it.”

In contrast to Powell’s warning, the Fed’s preferred measure of inflation showed that price increases slowed in July. The Personal Consumption Expenditures price index released earlier on Friday rose 6.3% from a year before, lower than the 6.8% year-over-year increase recorded in June.

“Powell and the Fed felt they needed to be hawkish,” Hatfield said. “Even if they are secretly encouraged about inflation, they’re definitely not going to say it.”

Wall Street reacted negatively to the tone of the speech, with the major indices dropping on the prospect of a sustained period of higher interest rates and the associated economic pain — a word Powell invoked twice in his brief speech, referencing slower growth, higher unemployment and financial strain that tighter policy will inevitably visit on American homes and businesses.

“These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain,” he said, pointing to the lessons officials learned from studying the Fed’s struggle to combat high inflation in the 1970s and 1980s.

An open question is how much pain the Fed will be willing to tolerate as it tries to reduce inflation by raising rates and destroying consumer demand. “We will have to see whether they have the strength of their conviction. If we continue to see inflation moderate more, and there is some weakness in the labor market,” said Drew Matus, chief market strategist at MetLife Investment Management.

“Powell is clearly stating that right now, fighting inflation is more important than supporting growth,” Jeffrey Roach, chief economist at LPL Financial, said in a research note.

Controlling inflation quickly is of paramount importance because inflation expectations can become a destructive self-fulfilling prophecy. “The longer the current bout of high inflation continues, the greater the chance that expectations of higher inflation will become entrenched,” Powell said.

“We don’t really understand the inflation expectation process,” said Randall Kroszner, former Fed governor and deputy dean for executive programs and economics professor at the University of Chicago Booth School of Business.

To a certain — albeit unquantifiable — extent, the perception that the Fed will have the intestinal fortitude to inflict pain on the economy in pursuit of its mandate is as important as the reality.

“Fortunately, the Fed has not lost credibility, and that’s something I think they will continue to rely on,” Kroszner said.