Natural gas futures surged on Monday to levels unseen since 2008 as the Northeast braces for a rare April blast of heavy snow.

The looming nor’easter will force millions of families to crank up the heat in the coming days, driving up demand for natural gas, the most popular way to heat homes in America.

Natural gas futures soared 9% to $7.96 per million British thermal unit (BTU) in recent trading. That’s the highest level since September 2008 and comes after natural gas jumped 16% last week alone.

The gains leave natural gas up by a staggering 113% since the end of last year.

The latest natural gas surge will only add to inflationary pressures in the United States, which is already grappling with a 40-year high in home prices.

The natural gas spike reflects the expectation of higher demand due to the unseasonably cool temperatures and below-average natural gas inventories in the United States.

“It’s mostly been cold and miserable,” said Robert Yawger, vice president of energy futures at Mizuho Securities.

Another factor: high coal prices mean power plants may not be willing to switch away from natural gas as a back-up plan.

“That traditional relief valve of shifting to coal is less likely,” said Rob Thummel, senior portfolio manager at TortoiseEcofin.

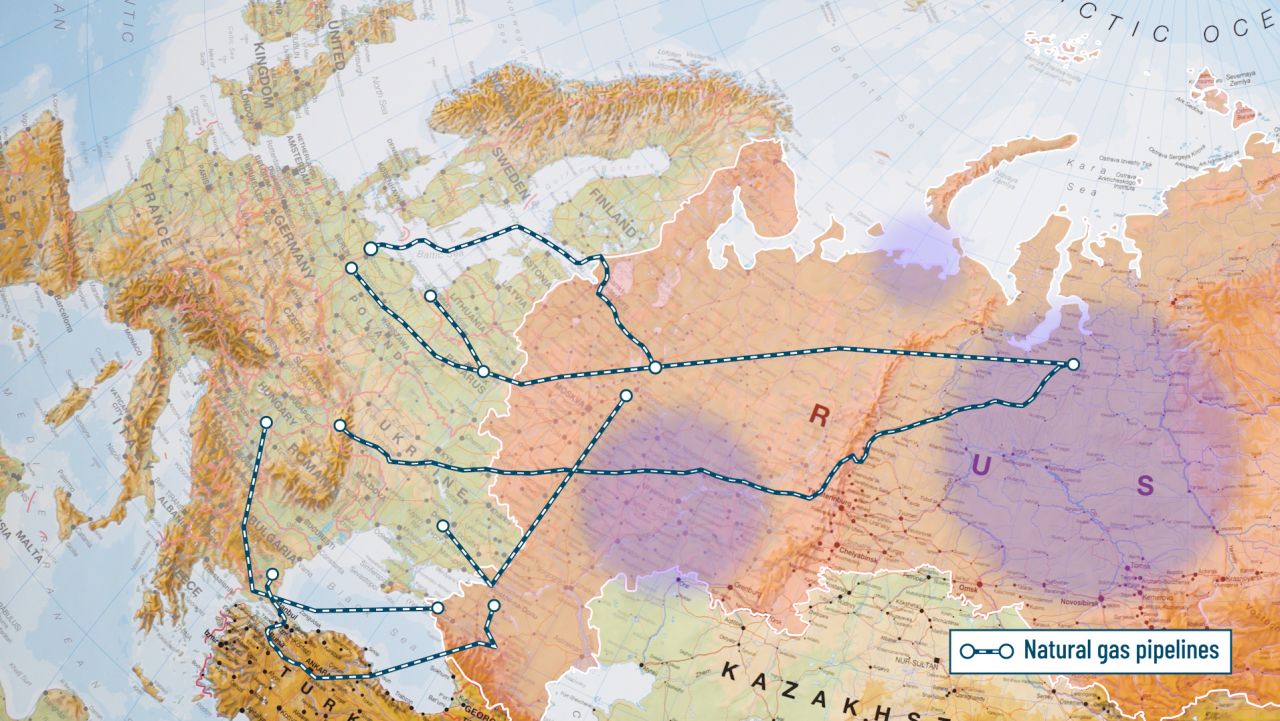

The war in Ukraine does not appear be a central driver of the supply-demand situation for natural gas, although it may be encouraging investors to make bets on natural gas. The United States has maxed out the amount of liquefied natural gas (LNG) it can send to Europe as it tries to wean itself off Russian energy.

Families are already paying more for energy. Prices for utility gas service soared by 21.6% in March from the year before, according to the Bureau of Labor Statistics.

The good news is that some analysts believe this natural gas spike will be relatively short-lived.

“This market could come undone really fast. It’s way overbought. You’ve got to wonder who is left to buy it,” said Yawger, noting that natural gas was the best-performing financial asset across Wall Street last week.

Thummel, the Tortoise portfolio manager, expects high prices will incentivize greater US supply and noted that consumers overseas are paying far higher prices.

“They are not going to stay this high forever,” said Thummel. “We think $7 is high? Europe and Asia are paying $35 for the same commodity.”