Brits are bracing for another huge hike in their energy bills, and pressure is mounting on the UK government to impose a windfall tax on big suppliers to offset some of the pain.

The head of Ofgem, the United Kingdom’s energy regulator, said on Tuesday that annual bills for millions of households would likely rise by about another £800 ($1,000) to £2,800 ($3,494) later this year.

The new rises would kick in starting October when Ofgem next adjusts its price cap, which is the maximum suppliers can charge customers per unit of energy. In April, the regulator raised the cap by a whopping 54% — the biggest increase since it began capping prices five years ago.

“We are expecting a price cap in October in the region of £2,800,” Jonathan Brearley, Ofgem’s chief executive, told a parliamentary committee.

Brearley said that the regulator had yet to complete its review of prices, and the cap could still change, but he acknowledged that it was a “very distressing time for customers.”

“This news will be utterly devastating for the 6.1 million homes currently in fuel poverty — and for the additional 1.7 million households who will spend this winter struggling to keep themselves warm,” Simon Francis, coordinator for the End Fuel Poverty Coalition, a campaign group, told CNN Business.

“Unless the government acts now, it will have blood on its hands this winter,” he added.

For months, campaigners and opposition politicians have called for a windfall tax on the bumper profits of energy companies at a time when households and businesses have struggled to keep the lights on. The money raised could be handed to people in the greatest need of help with their bills.

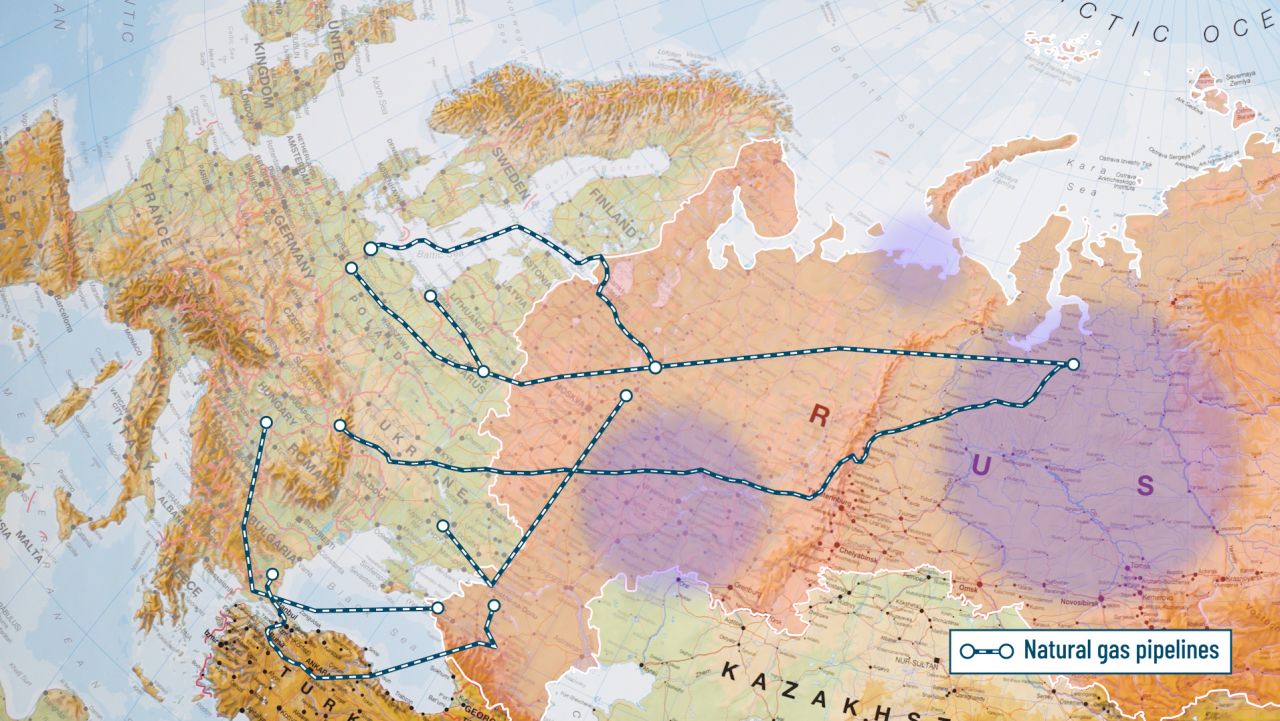

Companies such as BP (BP) and Shell (RDSA) have benefited from rising global oil and natural gas prices, which shot even higher in recent months as Russia’s invasion of Ukraine sparked fears of a global supply crunch.

So far, the UK government has resisted imposing any new taxes. On Tuesday, Energy Minister Kwasi Kwarteng reiterated his opposition to a windfall tax, according to Reuters, arguing that it was not the right approach to tackle the soaring cost-of-living crisis.

But the decision rests with the country’s finance minster, Rishi Sunak — and he may finally be listening to campaigners.

The Financial Times reported on Tuesday that Sunak was preparing to tax the profits of North Sea oil and gas producers — a measure the opposition Labour Party estimates could raise £2 billion ($2.5 billion) — and go even further by raking in more than £10 billion ($13 billion) from big electricity generating companies such as EDF (ECIFY)and RWE (RWEOY).