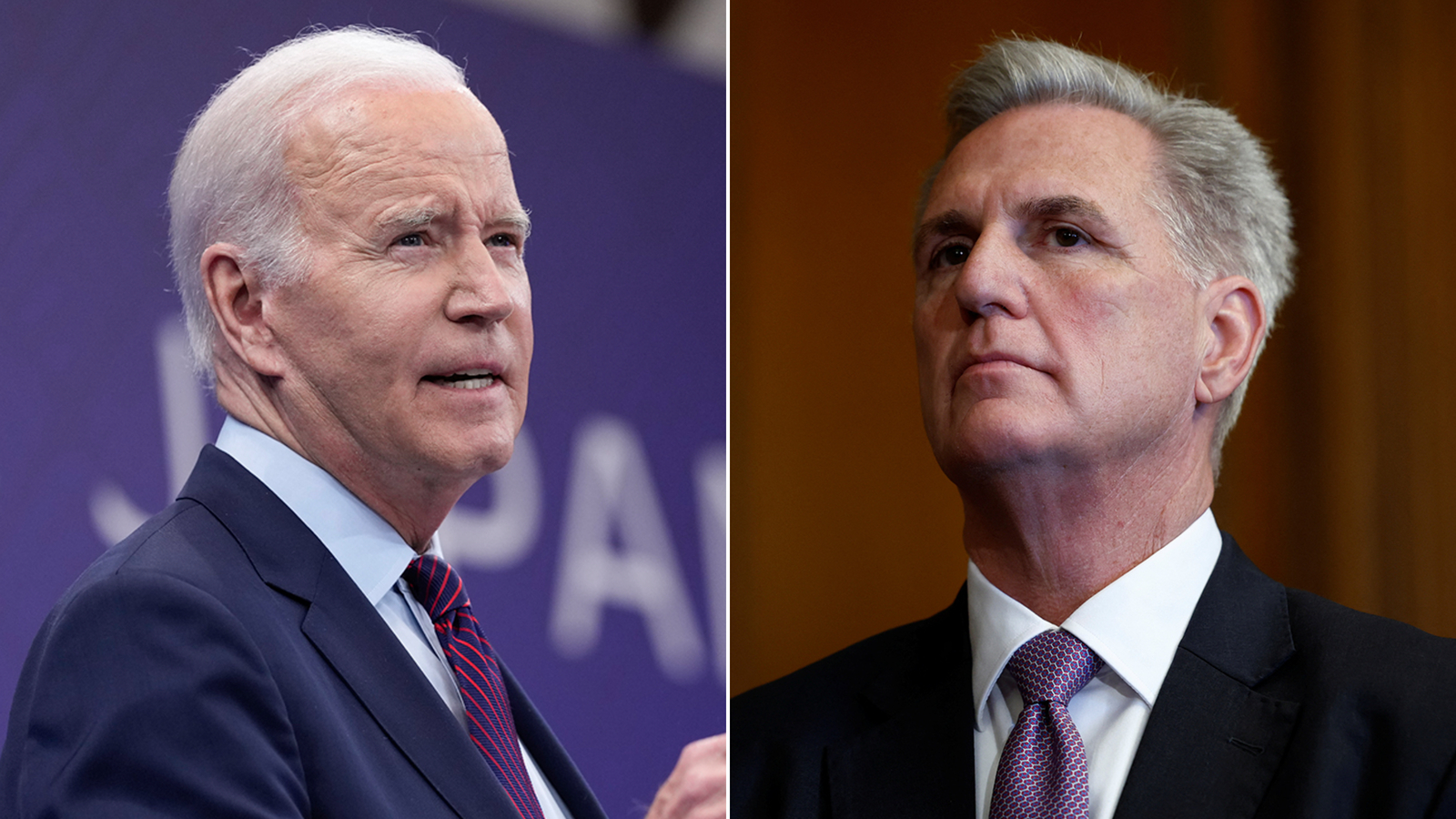

President Joe Biden and House Republicans have reached an agreement in principle to raise the debt ceiling and cap spending, after several weeks of tense negotiations.

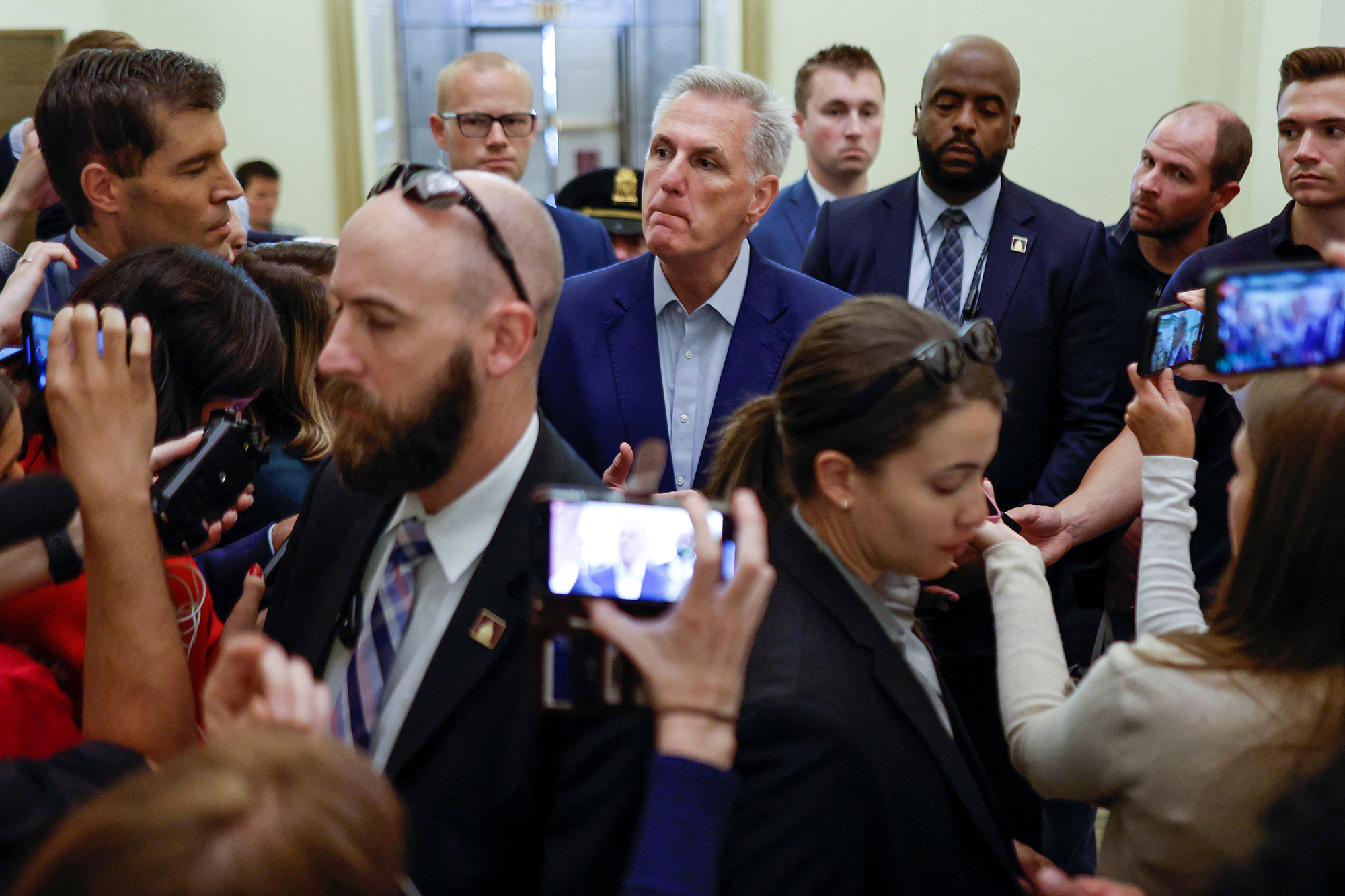

Now, congressional leaders in both parties have to convince enough of their members to vote for the agreement, which contains provisions that lawmakers on each side of the aisle don’t support.

Here’s what we know about the deal, based on a fact sheet circulated by House Republicans and a source familiar with the negotiations.

Raises the debt ceiling: The agreement would increase the debt limit for two years.

Caps nondefense spending: Under the deal, nondefense spending would remain relatively flat in fiscal 2024 and increase by 1% in fiscal 2025, after certain unspecified adjustments to appropriations are made, according to the source.

After fiscal 2025, there would be appropriations targets, but they would not be enforceable, according to the source.

The House GOP fact sheet says nondefense discretionary spending would be rolled back to fiscal 2022 levels and topline federal spending would be limited to 1% annual growth for the next six years.

Expands work requirements: The agreement calls for temporarily broadening work requirements for certain adults receiving food stamps.

Currently, childless, able-bodied adults ages 18 to 49 are only able to get food stamps for three months out of every three years unless they are employed at least 20 hours a week or meet other criteria. The deal would raise the age to 54, according to the source. The GOP fact sheet says it would apply to those up to age 55.

Restart student loan repayments: The deal would require borrowers to pay back their student loans again, according to the House GOP fact sheet, although when repayments would start is not specified. They have been paused since the Covid-19 pandemic began.

Read more about the deal here.