Watch “Erin Burnett Out Front” tonight at 7 p.m. ET for more on this story.

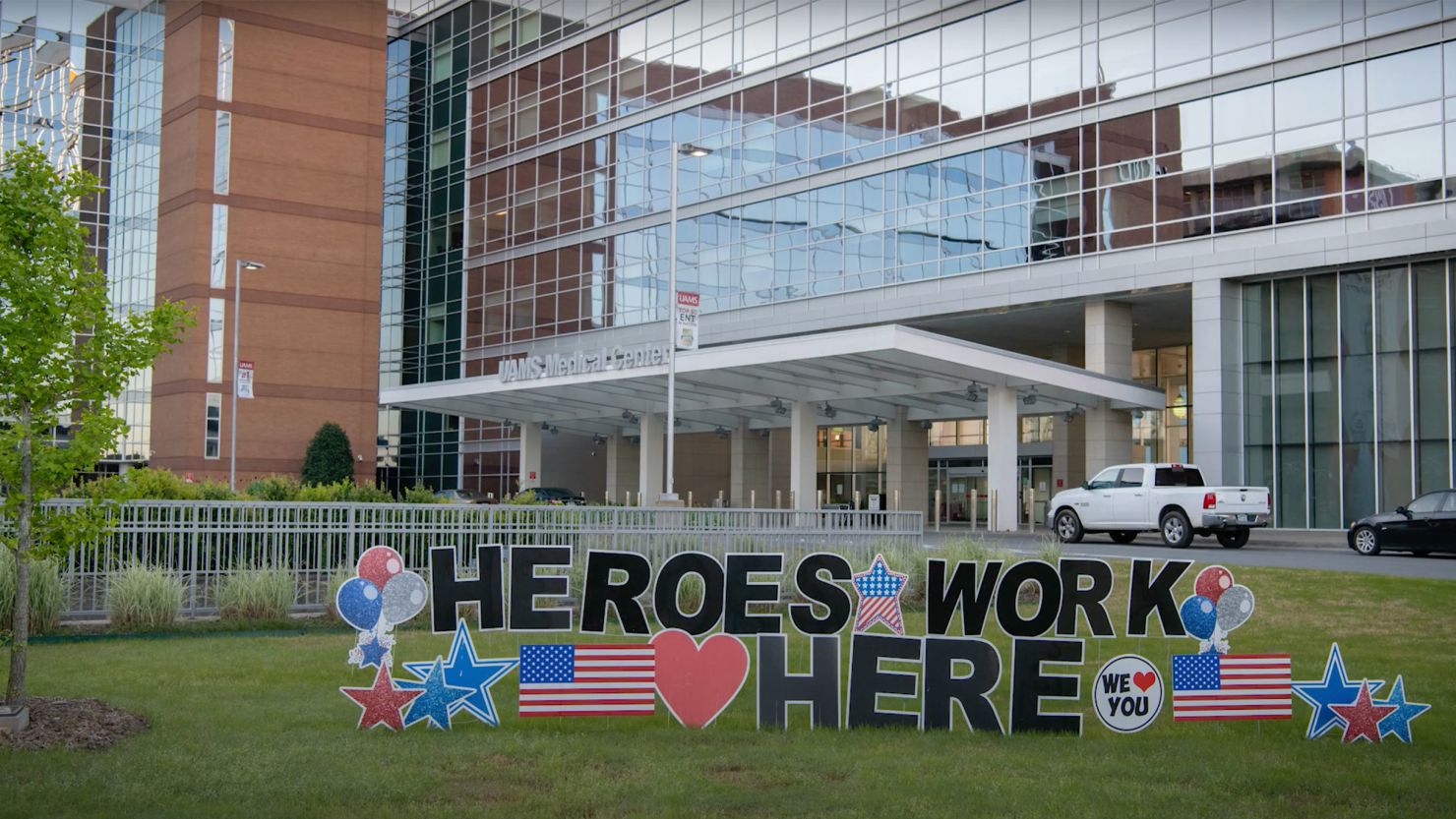

As Covid cases spread in 2020, visitors to the University of Arkansas for Medical Sciences were greeted by a colorful sign put up by grateful neighbors outside the university’s medical center: “Heroes Work Here.”

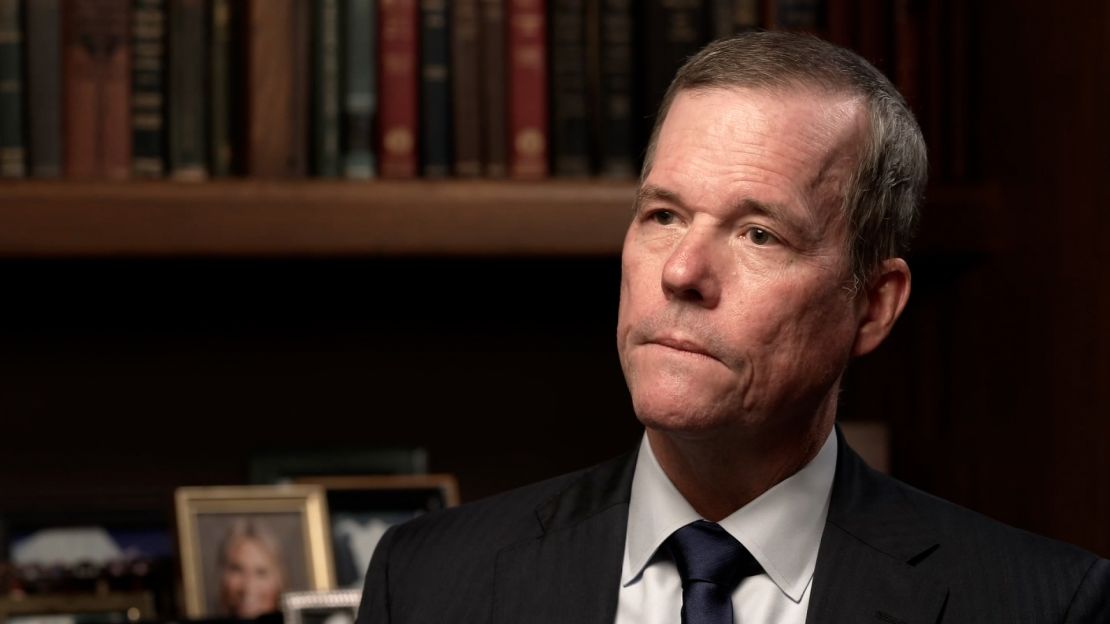

The university adopted the message in glossy promotional videos it posted online, introducing viewers to individual nurses, doctors, and health workers who described their jobs. “Sometimes it’s easy for people who pass through here to see our frontline caregivers as the heroes, or our educators as the heroes – it’s really everybody,” Cam Patterson, the university chancellor, declared in one video.

But at least a dozen of the “heroes” that UAMS featured in online advertisements and other videos weren’t just employed by the university – they’ve also been sued by it.

UAMS, Arkansas’ flagship public health sciences university, has been aggressively suing thousands of former patients over medical debt in recent years, including hundreds of its own employees, a CNN investigation found.

Since 2019, UAMS has sued more than 8,000 patients to collect on unpaid medical bills, according to court records. It filed more debt collection lawsuits in recent years than any other plaintiff in the Arkansas court system other than the state tax office.

The university’s use of the courts ballooned during the coronavirus pandemic. It filed 35 lawsuits in 2016 but more than 3,000 in 2021 – an average of nearly nine a day.

CNN reviewed court documents from thousands of UAMS lawsuits and identified more than 500 defendants who were listed as working for the university itself. The employees ranged from nurses and patient services associates to clinical technicians and lab workers to housekeepers and cooks.

Twenty people sued by UAMS, including more than a dozen current or former employees, spoke to CNN about their cases. Keri Whimper, a former UAMS medical assistant, said the university’s lawsuit against her – demanding a total of about $700 for a bill she thought had been covered by insurance – felt like a betrayal after she contracted Covid while working at the medical center.

“I worked for them through Covid, and they’re still doing this to me,” she said. “This really shows they don’t care about their employees at all.”

UAMS, which is part of the state government and is Arkansas’ largest public employer, operates a major teaching hospital in the state capital of Little Rock and runs clinics around the state. Its legal practices, which have not been previously reported, are an example of how aggressive medical debt collection efforts aren’t limited to corporate, for-profit hospitals.

Most of the lawsuits UAMS filed in recent years involved unpaid medical bills of about $1,000 or less, with some cases over as little as $100. In its complaints, the university tacked on hundreds of dollars of court filing fees, attorney fees, service fees, and interest charges, sometimes doubling or tripling the original amount owed. It moved to garnish defendants’ wages or bank accounts in thousands of cases.

In an interview, Patterson, the chancellor, said he hadn’t been aware of the number of employees UAMS was suing until CNN informed him, and said the university was evaluating changes to its collections policy. But he defended the lawsuits as important to the institution’s finances, especially at a time that it has faced budget shortfalls and layoffs.

“We can’t fulfill our mission if we’re not getting paid for the work that we do,” Patterson said, adding that the university provides free care to many low-income patients and “we don’t take legal action against people who can’t pay.”

State financial records show that UAMS regularly takes in more than $1 billion in payments from patients and insurers each year – suggesting that individual debts of a few hundred dollars were a drop in the bucket.

But the lawsuits had dramatic consequences for some defendants. Some patients declared bankruptcy after being sued by the university, and others, like Renee Russell, told CNN that the lawsuits and garnishments forced them to take on second jobs or cut down on food for their families.

“What they took from me was life-altering during a hard time,” said Russell, who was sued over about $3,000 in bills.

Berneta Haynes, a lawyer with the National Consumer Law Center who’s studied medical debt, said UAMS appeared to be using some of the industry’s “most egregious types of collections practices.”

“Hounding people for money, wage garnishments, seizure of bank accounts, all over minimal amounts of money… it feels draconian and cruel,” Haynes said. “This is why people end up avoiding necessary healthcare, because they don’t want to face the spiral of medical debt.”

Suing their own employees

In one of the university’s pandemic-era promotional videos, which features employees discussing the slogan “UAMS Strong,” a student recruitment director says that the phrase “means to me that we’re all in this together, that we’re supporting each other, that we’re lifting each other up.”

But the day before the video was posted to YouTube, the director was served with a lawsuit from her employer over $700 in unpaid medical bills. The university went on to garnish a portion of the very same wages it was paying her, according to court documents.

Her experience was hardly unique. In addition to the more than 500 current and former UAMS employees that CNN found had been sued, about 100 other defendants were listed as working at Arkansas Children’s Hospital, which is affiliated with UAMS. Those numbers are likely undercounts, as thousands of additional cases did not include employment information or did not have case documents available in Arkansas’ online court database.

Employees being sued told CNN they had gone to their employer for medical treatment either out of convenience or because of incentives in their insurance. UAMS’ health insurance program offers employees lower deductibles and copays if they go to UAMS doctors and facilities for their medical care instead of other in-network providers that aren’t part of the university.

Current UAMS employees – who asked to speak anonymously to avoid retaliation – said the cases against them were demoralizing and infuriating.

One nurse sued by UAMS worked long hours coordinating Covid care during the height of deadly surges in case numbers. She remembered calling hospital after hospital trying to find beds for patients who needed to be intubated, knowing that if she couldn’t find them a spot, they would likely die.

Around the same time, she said, she was personally receiving collection calls about years-old medical bills from her own employer. UAMS sued her and, after winning a default judgment, moved to garnish part of the wages it was paying her, according to court documents.

Getting sued after working through the worst of the pandemic was “a punch in the gut,” the nurse said. “We’re a revenue source, and if they don’t get their revenue, they sue us for it.”

Another nurse, who was sued by her employer over a bill for medical treatment provided to a family member, said that the lawsuit was “a bombshell in my finances.”

“It’s a crappy way to treat anybody, especially somebody who comes to work for you, working their butt off during Covid,” she said. “Just the humiliation of it, and feeling like they don’t really have your back, it hurts.”

Some employees were making annual salaries of about $30,000 or less when they were sued, according to financial records.

A housekeeper at the hospital said she didn’t realize she had been sued by her employer until they started garnishing part of her paycheck, because court documents were sent to her old address. She said she was forced to get a second job at Walmart to keep up with her bills.

“Y’all say you’re for the people, but how am I going to survive when you’re taking hundreds of dollars out of my paycheck?” she asked.

On the other end of the pay spectrum, a handful of the defendants were doctors, professors or departmental leaders. The university sued its chief of pediatric emergency medicine over nearly $2,000 in medical bills in 2021. He resigned his job in the following months to take a position elsewhere – but UAMS still garnished a portion of his last paycheck, according to court records.

A UAMS spokesperson said the university couldn’t comment on individual cases due to health privacy laws, but would review the examples CNN cited.

Patterson, the chancellor, said UAMS hadn’t previously received complaints from employees about the collections process, but that “it breaks my heart” to hear some of what workers told CNN about being sued. He said that the university had recently convened a working group to evaluate its billing and collections policies and make recommendations for changes.

“We don’t like to think about pursuing legal action for anybody,” he said. “And we’re very interested in finding ways in which we can accomplish the same goal without having to resort to legal action.”

A barrage of lawsuits

For years, UAMS only filed a few dozen medical debt lawsuits annually. But that changed in 2019, as the university pursued cost savings and partnered with a new debt collection firm – and the numbers skyrocketed during the pandemic.

In 2021, UAMS filed more than 3,000 lawsuits – nearly 100 times the number it filed five years earlier.

The jump in lawsuits appears to be linked to UAMS’ work with Mid-South Adjustment Company, an Arkansas debt collection firm. Court documents in some of the lawsuits state that bills should be paid to Mid-South, and most of UAMS’ debt collection lawsuits are represented by Brad Dowler, an attorney who also represents Mid-South.

UAMS first began paying Mid-South during its 2019 fiscal year, according to financial records – the same time the number of lawsuits jumped. Since then, it’s paid the company more than $3.1 million. In addition to collections, Mid-South also provides UAMS other services such as patient communications and insurance verification, according to a contract bid. Dowler and Mid-South’s president declined to comment on the lawsuits.

As UAMS increased its lawsuits, it was in the process of rebuilding its finances. In early 2018, the university cut several hundred jobs as it faced a large budget deficit. Patterson, the university’s new chancellor, arrived in June 2018 and declared in an interview on his first day at work that “the mission of UAMS is not to make money” but to “serve the people of Arkansas.”

In recent years, the university has seesawed between a stronger and weaker financial picture. It recently announced plans to lay off 51 employees amid a $30 million deficit. But in its 2021 fiscal year, UAMS recorded its highest increase in net position in more than a decade, thanks in part to federal Covid-related funds – and it still sued thousands of people.

Patterson said that UAMS does not collect debt owed by patients with a household income less than 200% of the federal poverty level – a total of about $60,000 for a family of four – or people who are unemployed or on Medicaid or Medicare. Each year, he said, the university writes off about $100 million in medical care for people who can’t afford to pay. And people who are not eligible for free care can set up payment plans to avoid lawsuits, in some cases paying as little as $5 or $10 per month, he said.

But those policies are not publicized anywhere on the university’s website. While UAMS has posted an application for financial assistance, some of the patients sued told CNN they don’t remember being informed about the possibility of receiving financial assistance or being encouraged to apply.

In contrast, UAMS’ largest competitor in Little Rock, Baptist Health Medical Center, has posted detailed online policies offering free care to families whose income is less than 300% of the federal poverty level, with exceptions based on assets. Baptist also lays out a litany of requirements and income checks that must take place before any collections lawsuit is filed.

A UAMS spokesperson said that hospital employees give patients a “one-on-one personal explanation” about their bills and available assistance.

Meanwhile, some other hospitals around the country have moved to limit or end their use of lawsuits to collect on medical debt. The University of Virginia Health System and Methodist Le Bonheur Healthcare in Memphis both reformed their collections policies after reporting from the nonprofit news outlets KFF Health News, ProPublica and MLK50 revealed the hospitals had sued thousands of former patients.

States such as New York, Maryland, New Mexico and California have also passed legislation in recent years banning or limiting the use of wage garnishments and other measures to collect on medical debt, although there’s been no similar move in Arkansas.

Nationally, nonprofit and public hospitals were among the most litigious at collecting medical debt, a Johns Hopkins University study from 2021 found. The study counted lawsuits by the 100 largest hospitals in the US – which did not include UAMS – and found that nine of the 10 most litigious were nonprofit or government-run.

Some longtime UAMS patients said they noticed a pronounced change in the hospital’s approach to collections in recent years. Suzanne Saettele, who got an emergency liver transplant at the UAMS Medical Center in 2005, has returned multiple times a year for tests and checkups since then. Living paycheck to paycheck, she said she struggled to pay the bills at times over the years, but the university was always willing to give her time to pay or set up payment plans.

“UAMS was 1000% on our side,” she remembered, citing their flexibility with bills and the hospital social worker who helped her apply for financial benefits. “I could just cry, they helped me so much.”

That changed in May 2021, when she got a knock on her door on the day of her daughter’s high school graduation. She expected flowers – and it turned out to be a man with a lawsuit from the hospital.

Even though she had been making regular payments on a previous UAMS payment plan, Saettele said, the university still sued her over several outstanding bills totaling $295. After attorneys and court fees, she owed $525, part of which the hospital garnished from Saettele’s bank account after winning a default judgment.

“It just broke my heart because they had been so good to us,” Saettele said. “I had such good care and felt so safe with them – and now I don’t.”

‘It hurt me big time’

Some patients sued by UAMS told CNN that the lawsuits against them had dramatic and long-lasting consequences for their personal finances.

The vast majority of defendants sued did not have an attorney and made no court filing. The university typically filed for default judgment, which was granted if defendants didn’t respond within 30 days of being served.

UAMS added hundreds of dollars of attorneys and court fees onto the hospital bills in its court complaints. After winning judgments, the university earned interest on the amount owed at rates that in some cases reached 9% each year.

“Those fees were horrible,” said Tonya Dixon, who was sued over about $1,000 in bills after giving birth to her son Lukas at UAMS. The amount she owed rose above $1,500 after attorney and court fees. “I told them, there’s no need to get a lawyer, I’m willing to pay you. But nobody listened.”

To collect on its judgments, UAMS moved to garnish defendants’ wages or seize money from their bank accounts in at least 5,000 cases since 2019, according to CNN’s analysis of court records. Some other defendants were allowed to set up monthly payment plans to avoid garnishment.

Notably, UAMS also exploited a loophole in state law that allowed it to collect on debts that may have been too old for most hospitals to bring to court. Arkansas’ statute of limitations blocks debt collectors from suing over medical debt if more than two years have passed since the debt was incurred or the last payment was made.

But in some cases, UAMS sued over debts that were three or four years old, because that statute of limitations doesn’t apply to the state government.

In one case, after the hospital sued a patient in June 2022 for medical treatment she received in March 2019, the defendant objected that the statute of limitations had passed. UAMS’ attorney, Tim Cullen, responded by citing an Arkansas Supreme Court ruling and wrote that “Plaintiff is an arm of the State of Arkansas. The statute of limitations does not run against the state.” The judge ruled in the university’s favor, and Cullen moved to garnish the defendant’s wages from the Department of Veterans Affairs.

A UAMS spokesperson objected to the idea that the law allowing the university to sue over older bills amounted to a loophole, and said the university waits at least a year before filing suit, and often longer, in order to reach out to patients multiple times and give them an opportunity to pay

Patterson said the university’s policy is to be transparent with patients about their bills and that defendants should have received plenty of notice before it gets to a lawsuit. “If people are being sued without understanding that they have unpaid bills, that’s of course too aggressive, that’s not our process,” he said.

Still, some patients sued said the university was unwilling to give them reprieves, even when they faced financial distress.

In 2021, UAMS sued Renee Russell for about $3,200 over a medical bill for treatment of her diverticulitis, plus more than $800 in attorney and court fees. The hospital garnished part of Russell’s wages from a dog grooming business, which she said had already dropped dramatically due to the pandemic.

Russell told CNN she called UAMS and its collections firm and asked about their financial assistance policy in light of her reduced income. “I told them I’m trying to pay this, but I am in a horrific financial bind right now with Covid … I’m barely keeping my head above water,” she said. But Russell was told it was “too late” for her to qualify for financial assistance because the lawsuit had already made its way through the courts, she said.

The garnishment, which took hundreds of dollars out of Russell’s paycheck, devastated her finances at the same time she was taking care of a disabled brother after her mother’s death and adopting a child, she said. To cope, she cut down on food for the family, took on extra jobs cleaning houses, and postponed crucial dental work.

As her savings evaporated, Russell wrote two handwritten letters to the court explaining her financial situation and asking for a reprieve. “I am begging for some relief,” she wrote. UAMS did nothing until a judge scheduled a hearing months later. The day the hearing was set to take place, the university agreed to lift the garnishment, and Russell said an employee of the university’s lawyer told her they would forgive the remaining $82 of her debt. But then, about two months later, UAMS moved to reinstate the garnishment – and took that last $82.

The impact of the lawsuit against her has been long-lasting, Russell said: Her credit score dropped from 750 to 480, and she’s still working to build up her savings again.

“It hurt me, it hurt me big time,” Russell said. “What did they gain from literally crushing me?”

CNN’s Curt Devine and Ashley Killough contributed to this report. Student journalist Emily Kennard also contributed for CNN.